Research-Driven.

A complex and ever-changing investment landscape provides challenge and purpose for our team.

Private Equity: Co-Investments

November, 2021 | Sean Montesi & Kojo McLennon

In our last piece, we discussed how private equity has produced returns in excess of public equities. Those results, coupled with other attractive features such as tax efficiency, a broad and expanding market opportunity, and diversification benefits have led to private equity being a growing component of many portfolios. We also discussed that we believe 2-4% outperformance versus public markets to be a reasonable expectation going forward for our private equity program. If that is the goal, how should an investor be positioned?

Our conviction lies in a portfolio equally proportioned to i) buyouts and ii) venture capital (“VC”) & growth equity (“growth”), with supplemental exposure to both through iii) co-investments (“co-invests”). In our next piece, we will further detail our approach and experience in the core of our program – buyout and VC & growth fund commitments. In this piece we discuss co-invests, a growing feature in our program and the industry broadly.

What is a Co-Investment?

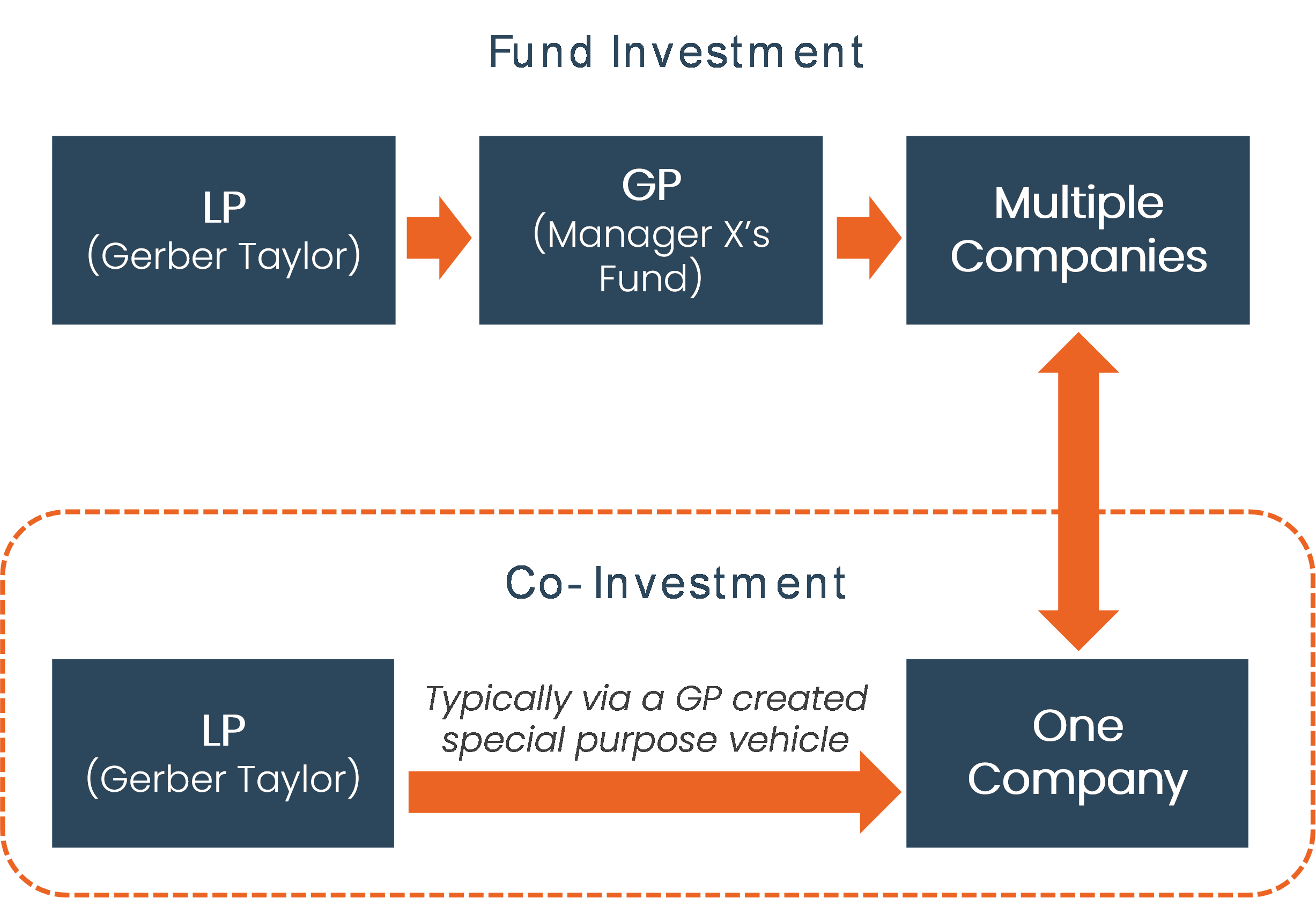

Co-investing is the practice of a limited partner (“LP”) investing directly into a business alongside a general partner (“GP”). In deals where their committed funds alone are insufficient for a variety of reasons (e.g., fund concentration limits, gaps in fundraise timing, etc.), co-invests allow GPs to maintain greater influence over the investee businesses, versus seeking entirely independent capital sources. GPs value LPs that can act quickly and with a degree of scale – both strengths of Gerber Taylor (“GT”) – and in exchange they generally offer more favorable economics than their primary fund terms.

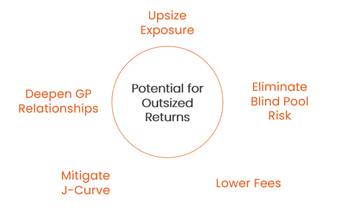

In addition to lower fees, co-investing has a number of other benefits, including:

- the ability to upsize exposure to attractive opportunities, sometimes businesses where GT has significant familiarity or related knowledge;

- eliminating blind pool risk by investing in a single, specified company;

- j-curve mitigation through immediate capital deployment, and little or no management fees; and

- deepening relationships with existing GPs or establishing new ones in a more incremental way relative to a fund commitment.

Co-Investment Efficacy

What does historical experience suggest about the effectiveness of co-investing? A 2018 academic study titled “Adverse Selection and the Performance of Private Equity Co-Investments” analyzed over one thousand co-investments from hundreds of funds from 1981-2010. They found a 0.1x to 0.3x net multiple out-performance for buyouts and a 0.2x to 0.4x net multiple out-performance for VC co-invests relative to the funds from which they emanated, deflating prior notions of adverse selection. This is a logical finding; consider the following simple example in support:

- whoever is selecting the co-invests is no better or worse at doing so than they are at selecting fund investments;

- rather than paying 2% & 20%, still the standard buyout and VC fee structure, the co-investor pays 1% & 10% (sometimes it is better than this, and can be as little as 0% & 0%); and

- the main fund returns a 3x gross (before fees), compared to a 3x gross return co-invest (before no or reduced fees).

In rough terms, the fee difference alone fully accounts for the net outperformance cited above. We believe a disciplined and experienced allocator, such as GT, can add incremental value through its selection capabilities.

GT Co-Investment Experience

Starting in 2012 and accelerating in 2018, we have now directly co-invested $41 million in 20 separate businesses as of November 30, 2021. We are continuing the evolution of our co-investment efforts with the launch of a dedicated strategy. We are targeting investments in 10-20 businesses in total through a combination of VC/growth and buyout investments. We look to invest capital to amplify exposure to high conviction, high-return opportunities emanating from our high-quality GP relationships. We are now reviewing over 100 co-invest opportunities per year to identify three to five investments annually.

Conclusion

As we discussed in Part I of this series, the benefits from private equity in a portfolio are clear. Some of the best global allocators, the largest endowments and foundations, have sizeable allocations to private equity. We encourage investors to take note, while pointing out that private equity involves an abundance of choices, a wide range of potential outcomes, and long-term commitments. We believe the depth of our experience, extensive knowledge of the space, and quality of our manager relationships make us well-equipped to implement a successful private equity program.

How one chooses to construct a private equity portfolio, on the other hand, is debatable. Our confidence lies in a mix of VC & growth, buyouts and co-invests. In this piece, we have described how co-invests are additive to our private equity program. In our next piece, we will delve into our experience and approach in making buyout and VC & growth fund commitments.