Research-Driven.

A complex and ever-changing investment landscape provides challenge and purpose for our team.

Dusting Off our Crystal Ball

August, 2021 | Charles Gerber and Tara Elliott

"Buy not on optimism, but on arithmetic." -Benjamin Graham

While it gets a lot of attention, historical relative performance should be a decidedly secondary consideration for investors. The primary goals in constructing investment portfolios are to generate a long-term return sufficient to cover spending, including taxes for families and individuals, and maintain purchasing power after inflation, all while assuming no more than an acceptable level of risk. Many investors seem to think this is a lay-up as recent robust returns and generally muted volatility have crept into investor expectations for the future. Consider the results of a recent survey of global investors which revealed long-term return expectations of 14.5% in excess of inflation!! Contrast this with the 5.3% long-term returns after inflation considered realistic by financial professionals in the same survey, or an expectation gap of 174%. A very high risk tolerance could account for some of this disparity, but investors expressed ambivalence on this topic. 58% said they were “comfortable taking risks to get ahead” while 75% said “they prefer safety over investment performance”. It sounds like investors want to have their cake and eat it too.

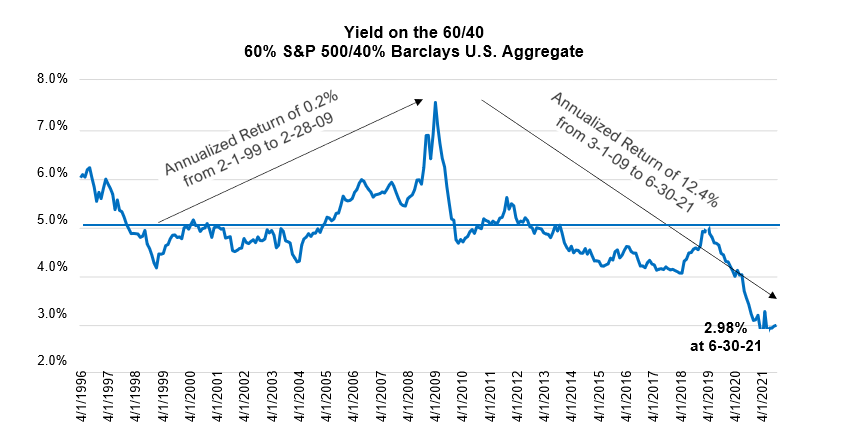

Taking Ben Graham’s advice, let’s take a look at forward return prospects for a blend of 60% U.S. stocks and 40% U.S. bonds, focusing on the math. A 60/40 mix is often the starting point for investors seeking balanced portfolios from a risk perspective. It has also proven to be a very difficult benchmark to beat in the twelve years since the Great Financial Crisis of 2008/2009. We have historically surveyed the long-term estimates for capital market returns from a variety of providers … Leuthold, JP Morgan, Goldman, Vanguard, GMO, and many others. We develop our own estimates but like to see what others are dialing up. Such projections mean very little in the short term (too many variables) but can be useful in thinking about the longer term (i.e., 7 to 10 years). For equities, most research groups use some variation of a methodology incorporating earnings, dividends and ending valuation estimates. The inputs for bonds are starting and ending yields, along with the rate of change in those yields.

Vanguard is the largest purveyor of index funds of all stripes and, as such, can be viewed as a relatively unbiased source for asset class expectations. Their latest ten-year forecasts are 3.4% for U.S. equities and 1.9% for U.S. bonds, which pencils out to a 2.8% prospective return for the 60/40 mix. Subtracting a basic inflation assumption of 2% leaves a real return of 0.8%. This is well below the ~5% spending needs of most investors and shockingly short of the 14.5% many investors are reported to expect.

Returns from here reflect the fact that the valuation of the 60/40 mix has almost never been higher. While headline equity valuations were higher in the late 1990s, the current level of bond yields has pushed the combined yield to a near all-time low. It’s also interesting to note the annualized returns over prior periods: 0.2% from the previous low yield point in 1999 and 12.4% from the peak yield in 2009.

Should the Vanguard projections seem conservative, consider those of Jeremy Grantham’s GMO: seven-year annualized real returns (after inflation) of -8.0% for U.S. equities and -3.1% for U.S. bonds – yikes! The primary difference in forward-looking returns for equities lies primarily in the estimate of ending valuations. The Vanguard methodology seems to accept a continuation of elevated valuations and margins which have prevailed since 1990, while GMO is committed to reversion to the mean as measured over a much longer historical period.

Inflation has been prominent in the financial press of late with prices of various materials spiking and a year-over-year increase of 5.4% in the Consumer Price Index in June. These elevated readings come after years of inflation falling short of the central bank’s 2% target. The Fed has downplayed inflation fears, labeling recent high readings as “transitory”, while debate continues as to what that term actually means. Certain pressures, such as supply chain disruptions, are clearly temporary and related to an economy recovering from lockdown. The meteoric rise in lumber prices, followed by a return to a more normal level, is an oft-cited example of these short- term disruptions.

Over the longer term, there are powerful opposing forces on either side of this debate. Inflation hawks point to the jaw-dropping amounts of stimulus aimed at stemming the successive crises of the Great Financial Crisis of 2008/2009 and the COVID-19 Pandemic of 2020/2021 which now reside on the balance sheets of the U.S. Treasury and the Federal Reserve. Add to that longer-term ramifications of capacity damaged by COVID, greater redundancy in supply chains in part due to U.S.-China conflicts, and pricing in higher costs associated with environment, social and governance (ESG) compliance. On the deflation front, the structural forces of demographics, technology and globalization continue to weigh on prices. Many economists prognosticate that inflation will settle at a higher rate than that experienced in recent years but not approach the hyperinflation rates of the 1970s as many fear – maybe 3-4%.

Ultimately, future inflation is, as Howard Marks says, “important, but not knowable.” It is important as inflation erodes nominal returns and spending power. Furthermore, higher inflation would almost certainly lead to higher interest rates and lower asset prices, as nearly all financial assets have been supported by the discounting mechanism of ultra-low interest rates. Still, it is yet another unknown in an environment laden with uncertainty.

The sanguine tone of the markets is incongruent with such worries. After hitting 1.75% earlier in the year, the yield on the U.S. 10-year Treasury retreated and is less than 1.20% as of this writing as the reflation trade has waned. Such a yield almost guarantees a negative real return on such a bond unless disinflation or deflation is in the cards. Meanwhile the equity markets continue to post new highs while pockets of speculative excess crop up in the form of SPACs, IPOs for money losing enterprises, and cryptocurrencies. Exogenous risks, such as China’s recent crackdown on for-profit education companies and U.S. listings, lurk alongside those we haven’t begun to consider (how many of us had a pandemic on our radar screen in 2019?). Perhaps the extreme government interference has dulled market signals for now, but what happens when the Fed starts to withdraw its support by raising short-term rates and tapering asset purchases?

So, the path forward does not look straight or easy – low returns for traditional beta, the specter of corrosive inflation, and higher volatility/uncertainty. If Vanguard is anywhere close with their projections, traditional market beta will not generate sufficient returns. Equities can and will surprise, but basic math says that a return of CPI + 5% is likely a bridge too far. The following is our broad prescription for such an environment:

• Talent Over Asset Allocation. We tend to be less dogmatic about asset allocation and more committed to maximizing the impact of talent. One quick example – we’ve been invested with a manager for 31 years that has never experienced a significant draw down. Their approach is to take a position and hedge out the risks they cannot control, such as market beta or commodity prices. In doing so, they dilute the return potential of the unhedged long position. Their returns can seem pedestrian in raging bull markets but have proven very valuable in down markets or times of great uncertainty.

• Equity-Centric. Even with headline valuations looking full to rich, equities play a central role in our playbook. Our equity exposure tends to be very diversified along geography (U.S. vs. international and emerging), style (growth vs. value), capitalization (large vs. small), market (public vs. private), and structure (long only vs. long/short). This broadens the opportunity set immensely. Foreign markets today stand at record discount to their U.S. counterparts, generally tend to be less efficient, and may offer a currency tailwind. Long/short strategies have struggled this year, mainly on the short side, but this may create a robust opportunity in less ebullient markets – many of our managers seem to think so. Equities, particularly those businesses with pricing power, tend to perform well in low to moderate inflation environments.

• Hedged Strategies in Lieu of Bonds. Portfolios need a certain amount of defense, and that role has traditionally been played by high quality bonds due to their key characteristics of low volatility, capital preservation, and limited correlation to equity-oriented strategies. With the U.S. 10-year Treasury yielding less than 1.20% today, bonds are poised to deliver minimal returns in a stable rate environment along with an asymmetric risk of loss in a rising interest rate environment. Rising rates could hurt equity prices simultaneously, destroying the diversification benefits of a simple stock/bond portfolio. In our piece, The Search for Portfolio Stability in the Era of ZIRP, we noted that a well-constructed hedge fund portfolio can fill the defensive role for investors while offering the structural advantage of multiple return drivers, independent of traditional equity and fixed income markets, with minimal interest rate sensitivity vis-à-vis core fixed income.

• Strategies with Low or No Correlation to Traditional Markets. With valuations of stocks and bonds full to rich, we seek allocations where success or failure is unrelated to broad market moves. A good example is a position that makes specialized loans to healthcare companies using the royalty streams of their approved therapeutics as collateral. This activity requires deep medical expertise as well as credit and structuring skills. With high barriers to entry, the competitive set is limited. This lender has committed $5 billion in 41 transactions over the last 12 years, generating low double-digit returns with no loss of principal and zero correlation to equity and credit markets.

• Opportunistic Allocations. Technological advancement is in hyper drive as COVID has accelerated change in some markets by ten years or more. We have had great success with targeted opportunity funds which amplify ideas that bubble up from our primary research work. Our biotech and venture strategies are good examples. These are typically high-risk, high-reward investments implemented with our highest conviction managers. These allocations need to be sized appropriately, and investors must be prepared to be patient through inevitable down cycles. We will continue to look for more of these compelling rifle shot opportunities.

One thing that we are not doing is looking for macro overlays to hedge risks like inflation. As one of our long-standing multi-strategy, trading-oriented managers, Whitebox Advisors, puts it, “you can get everything right at the macro level and still be wrong on securities prices. As we see it, that is all the more reason to focus on trading and portfolio flexibility, especially when the risk of significant market shifts seems higher than normal.” In case we did not make this clear in our previous comments, we have no confidence we can get everything right at the macro level. Rather than delude ourselves to the contrary, we embrace uncertainty and build portfolios accordingly, populating them with a broadly diversified set of return drivers. By definition, these portfolios are not overly optimized for a particular environment as the 60/40 has been for the period since the Great Financial Crisis. Just as the fragility of “optimized” supply chains was exposed by the stress of COVID, we believe excessive reliance on a limited number of highly valued asset classes (i.e., the 60/40) will prove similarly disappointing and lead to widespread calls for reevaluation – after the damage has been done. All we know is that the future will look different from the past and almost certainly require a different prescription to generate satisfactory returns.

August, 2021

Charles Gerber and Tara Elliott

Disclosures: The discussions and opinions in this letter are for general information only, and are not intended to be, nor should it be construed or uses as investment, tax, ERISA or legal advice. While taken from sources deemed to be accurate, Gerber Taylor makes no representations about the accuracy of the information in the letter or its appropriateness for any given situation. Opinions offered constitute our view and are subject to change without notice. This information does not constitute an offer to sell, or a solicitation of any offer to buy any security, including an interest in any private fund. Any offer or solicitation of an investment in any private fund may be made only by delivery of the confidential offering memorandum of such private investment fund to qualified investors.