Research-Driven.

A complex and ever-changing investment landscape provides challenge and purpose for our team.

2025 Private Equity Outlook

May, 2025 | Kojo McLennon, CFA

2025 Private Equity Outlook

By now, you have undoubtedly read many 2024 retrospectives and, admittedly, year-end seems a long time ago given the heightened policy uncertainties which have spilled over into capital markets. Because we’ve received a number of questions on private equity in the current environment, we felt it worthwhile to provide a review of 2024 now that year-end marks are largely in, followed by our outlook.

While investing rarely follows an uninterrupted path, we continue to believe private equity can offer the following for investment portfolios:

- Broaden equity portfolio scope from public-only to public and private;

- Deliver long-term, tax-efficient returns;

- Enhance total portfolio performance by capturing the illiquidity premium; and

- Access consistent sources of active return.

We have even more confidence in our approach which favors managers who operate in less efficient areas of the market and have the capacity to actively create value rather than rely on a more passive approach reliant on financial engineering.

2024 Market Environment

In 2024, GPs confronted some LPs’ most pressing demand: more liquidity and progress in reducing the inventory of companies added during the 2020–2021 boom — a self-inflicted issue stemming from overallocation to private markets by some larger allocators. Evaluating the managers we track within two main private equity strategies on the liquidity front, Buyout fared slightly above average, while venture capital/growth lagged well below historical standards.

Enabled by a lower cost of capital, Buyout investment and exit activity exceeded pre-pandemic levels. First, banks re-entered the lending markets, increasing competition and compressing spreads. Then came 1.0% in Fed easing starting in September. This gradual revival of "animal spirits" narrowed the gap between buyers and sellers, encouraging transaction activity. Still, the hurdle remained high for monetization. Given recent valuation uncertainty from a higher borrowing cost regime, GPs were reluctant to sell prematurely. As a result, only the highest-quality positions went to market, whether via outright sale, dividend recap, or continuation vehicle.

Venture capital (“VC”), on the other hand, has more ground to cover. Following the “great reset” of 2022, when both valuations and investor participation declined, today’s investment environment strongly favors capital providers. With a new wave of strong entrepreneurs and innovative startups, the setup for future returns looks attractive. While innovation extends far beyond AI, the sector dominated, capturing 46% of total VC dollars.

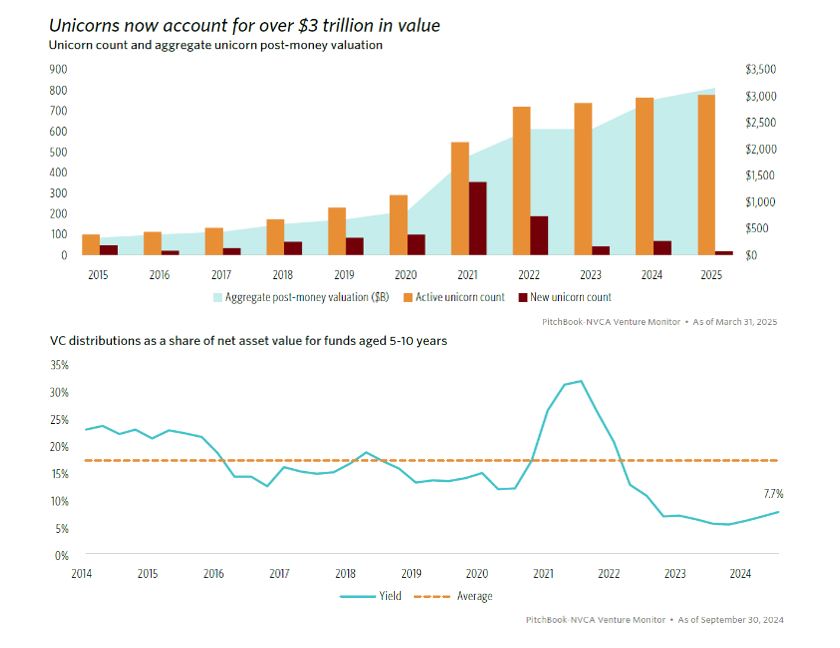

However, market conditions did not support VC exits. Regulatory constraints on mergers and a lack of IPOs hindered liquidity. As a result, the pool of unicorns (companies valued above $1 billion) remained largely illiquid — and actually expanded. Companies are indeed staying private longer, as the exhibits below illustrate.

Private Equity Outlook

Private equity investors were optimistic entering 2025. Early expectations for further Fed cuts, lighter regulation, and robust public markets boosted deal and IPO sentiment. Unfortunately, those hopes were replaced with substantial uncertainty driven by unpredictable economic policy. Like many, we offer no predictions about tariffs or regulatory shifts, nor their long-term impacts.

We know that the public markets are being buffeted on a nearly daily basis by various policy announcements, pauses, and responses. This has naturally led to questions about how we expect private equity to fare in this environment. Our answer varies depending on whether we are speaking of conventional private equity or the GT approach to private equity. The majority of the industry activity involves the largest funds and the largest private companies. Bidding for deals tends to be very competitive, and purchase prices have mirrored recent public equity markets with higher valuations. Successful outcomes in the large buyout space often rely on financial engineering and significant debt financing, which is more expensive and harder to come by in today’s environment.

We have always favored less competitive areas of the private markets where managers can drive returns more independent from the public markets. As such, we do not plan any material changes to our strategy. While private markets may move more slowly under current conditions, we will continue to focus on our core private equity strategies of buyout, venture capital/growth, and co-investments with heightened awareness of emerging risks — but without overreacting.

Diversification remains a top priority. The combination of strategies described above captures a broad spectrum of growth drivers and performance characteristics. Sector, geographic, and time diversification will help further mitigate uncertainty. Strong operating capabilities, a longstanding priority in our sponsor relationships, seem more critical than ever. Expect us to maintain that emphasis while pursuing active value creation.

May 2025

Kojo McLennon, CFA