Research-Driven.

A complex and ever-changing investment landscape provides challenge and purpose for our team.

Reflections on 2022 & the Road Ahead

January, 2023 | Charles Gerber & Tara Elliott

Best wishes for a happy, healthy, and prosperous year in 2023! Given last year’s tumult, we wanted to share our thoughts on 2022 and the road ahead. Here we ask ourselves what we consider to be the key big picture questions.

Now that you’ve had some time to reflect, what do you think about 2022?

Tara: What a year! 2022 was marked by significant volatility as investors careened between fears of persistent inflation necessitating higher interest rates and hopes that inflation would quickly abate, allowing the Fed to reduce or pause the pace of interest rate hikes. The results for the full year reflected more of the former with the S&P 500 Index down -18.1% and the Bloomberg US Aggregate Bond Index losing -13.0%.

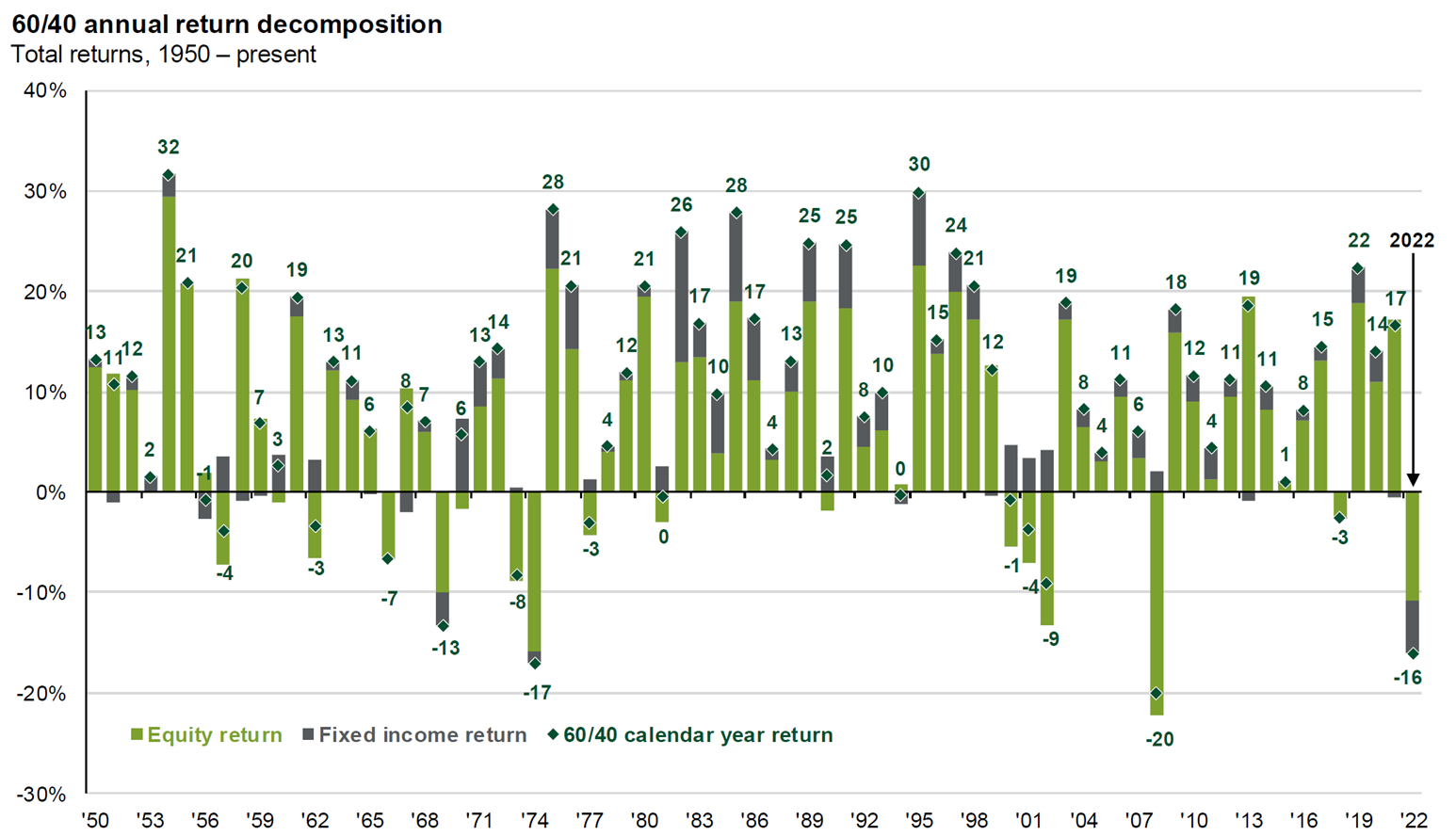

While it is true that corrections, while unpleasant, are normal and healthy for markets, 2022 was somewhat unusual in that it delivered sharp corrections in both the stock and bond markets. This obliterated the traditional route for diversification, leaving investors with nowhere to hide. A simple portfolio of 60% U.S. stocks and 40% bonds (assuming no rebalancing during the year) declined -16%, its worst performance in more than seventy years with the exceptions of 1974 (-17%) and 2008 (-20%).

Charles: Yes, last year was sort of a perfect storm – coming out of the pandemic, tons of stimulus dollars sloshing around, supply chain disruptions and then the Russian invasion of Ukraine. Along with the human aspects, that had a significant inflationary impact on prices of energy, food and fertilizer prices. I think inflation peaked at about 9%, and the markets have become accustomed to 1-2% for the last ten years or so. The yield on the 10-year Treasury moved from 1.5% to 4.3% during the year, and that certainly got the markets’ attention. We kept thinking of the Buffett adage that “interest rates are to asset prices what gravity is to the apple.” That certainly explains much of the action in the markets. There were very few places to hide in 2022. Inflation began to slow, and longer term rates moderated in the 4th quarter, giving equity markets a reason to come back to life. That appears to have carried over to the start of the new year.

How do you think about portfolio construction in the current environment?

Charles: While each client relationship is customized, our basic architecture is always the same … equity centric, highly diversified, and actively managed (as opposed to indexed) … an all-weather approach. We are hesitant to make substantial changes to that basic architecture as we are not good at market timing. Our history shows that we are generally more successful in adding incremental value during market drawdowns. That was true last year when our relative results were pretty good. Our diversified allocation was substantially accretive, but we lost some of that advantage as stock selection at the manager level hurt.

Our mix of investments is roughly one-third global equities, one-third hedged strategies and one-third private investments. This is somewhat similar to the universe of large endowments. While there is little activity in the basic allocation mix, there is substantial activity within the broad allocations at the portfolio level.

Tara: That last point is absolutely essential to understanding how we think about portfolio construction. We deliver exposures across asset classes through a multi-manager approach. This structure provides the flexibility to lean into opportunities in real time – from a fundamental, bottoms-up perspective. We believe very few investors, if any, are equipped to time markets effectively over the long-term. Examples of current activity at the fund level include gradually adding to beaten up technology stocks within U.S. equities and preparing for a potential credit cycle within multi-strategy allocations.

Have you made any changes to your target asset allocation post the market correction?

Charles: Not many. We have increased our target allocation to private equity, but just marginally from 15% to 20%. We continue to find attractive entry valuations in the private markets. Because we’ve done this for so long, we have long-standing relationships with managers who do the really hard work of building and improving smaller businesses. We think private equity, in the way we approach it, offers attractive returns and favorable tax treatment for our taxable investors. We also think that targeted real asset opportunities can be good diversifiers and helpful in a higher inflation environment. We are reviewing new investments for the latest vehicle of our real assets program.

Tara: One more point on private equity – historically, post-recession vintages have produced the highest returns. On the allocation front, many investors are asking about fixed income now that yields are significantly higher. Bonds are certainly more attractive than they were a year ago, so increasing them is appropriate for some investors, especially those with near-term needs. This is part of the customization process. More broadly, with the yield on the Bloomberg Agg at ~4.3%, we still believe hedged strategies offer higher return prospects over intermediate time horizons.

What are you excited about going forward?

Tara: As contrarian investors, we tend to like things that have been out of favor. That means asset classes outside of the domestic 60/40 mix which has been fueled by declining interest rates. That environment favored bonds and passive U.S. equities, in particular. On the other hand, active management has been a tough row to hoe. We believe that the end of easy money, in the form of higher interest rates and quantitative tightening, will return individual company fundamentals and quality to the forefront. This should create more differentiation among companies to the benefit of stock pickers. As an amplified form of active management, long/short equity should also benefit with the added boost of higher short rebates1.

Equities domiciled outside the U.S. have lagged their domestic counterpart for several years with currency being a major factor. Dollar strength reversed in the fourth quarter, demonstrating how quickly extended trends can correct. Even after the fourth quarter rally, foreign equities continue to offer a compelling combination of more attractive valuations and cheaper currencies.

What makes you cautious?

Charles: As we look forward, the long-term expected returns for both equities and debt look more attractive. Valuations are down, sentiment is largely bearish, and the macro environment is ugly. The war in Ukraine is first and foremost a human tragedy, but also an unpredictable variable in energy, food and fertilizer markets, all important inputs in the global inflation outlook. Other geopolitical hotspots include China / Taiwan, Iran, and North Korea. So, there’s lots to keep us up at night, but in truth, that’s always the case.

Tara: Expected returns are definitely higher than they were a year ago, but valuations in many asset classes were only back to long-term averages at year-end. This is most glaring in U.S. equities and credit spreads. That’s not a terrible setup, but it also doesn’t offer much margin of safety as companies face earnings pressures. By nature, we are worriers. In addition to some of the challenges Charles mentioned, I would add uncertainty around the efforts to end the grand experiment called quantitative easing. It remains to be seen how the withdrawal of such vast amounts of cheap liquidity will affect the global economy, markets, and geopolitics.

Now, for the last word …

Charles: In our world, the crystal ball is always cloudy and opaque. Our expectations for asset class returns have been significantly below long-term averages, especially in recent years. Zero interest rates and record-high equity multiples will do that. That has changed somewhat in light of last year’s market losses. Valuations are a little closer to historic norms, providing a means to reasonable returns going forward. The path of those returns is not known, and we will remain disciplined and consistent in our approach.

January 2023

Charles Gerber & Tara Elliott

1 For easy-to-borrow names, the typical short rebate that a hedge fund earns on the proceeds of its short sale might be the fed funds rate less a fee of 0.25%. With the current fed funds target rate between 4.25% and 4.5%, this means that the starting return on a short portfolio could be up to 4.25% before accounting for changes in the stock prices.