Research-Driven.

A complex and ever-changing investment landscape provides challenge and purpose for our team.

Exploring Uncorrelated Strategies

March, 2022 | Charles Gerber & Tara Elliott

Let's start with this statement... "You're tired of hearing this and we're tired of saying it."

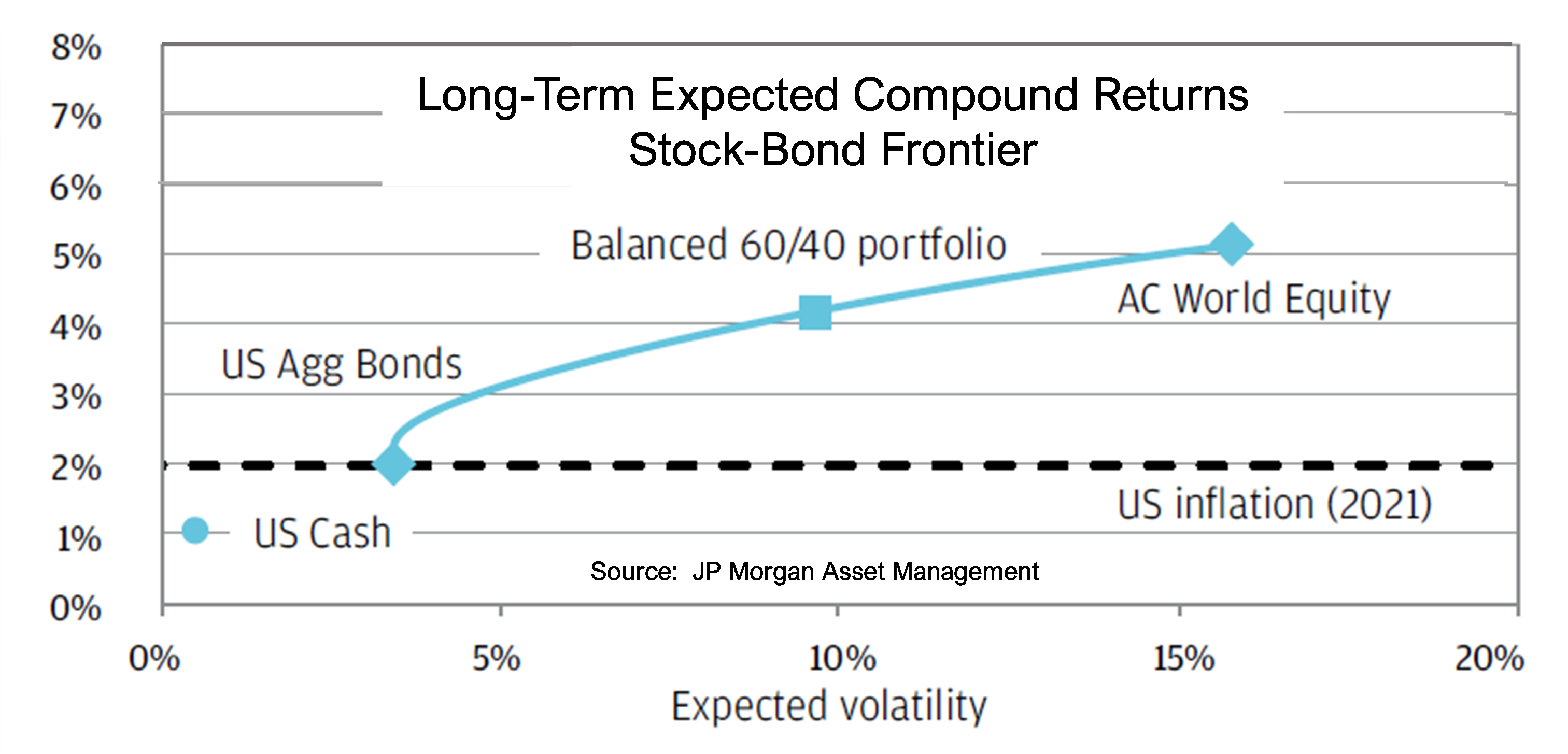

Unfortunately, it remains true and we've got to say it anyway ... markets are very rich, and long-term return expectations are very unattractive. While it is tempting to simply accept and enjoy the lofty returns the markets have provided in recent years, history and experience tell us it is unwise to ignore the risks that accompany the current market dynamics and economic realities. The simple chart below illustrates the expected return for the 60/40 mix of world stocks and bonds over the longer term...10 to 15 years. Sadly, these are nominal numbers, so you'll need to deduct the inflation rate out to calculate real performance (inflation is currently running at ~5%). These return expectations are not materially different from our own prognostications. We talked about this in our recent piece Dusting Off Our Crystal Ball, so we won't belabor the point.

Instead, we want to spend the majority of this communication discussing one of the things that we’re doing about it. In a nutshell, we're searching for and finding interesting strategies that can deliver returns regardless of the direction of the markets. This is easier said than done. As all of us who experienced the GFC (Great Financial Crisis of 2008/2009) will remember, asset classes tend to move in sync when investors are scared. In this search for low correlation assets, it's imperative that we look beyond backward-looking statistical relationships and dig deeper to find understandable, idiosyncratic return drivers.

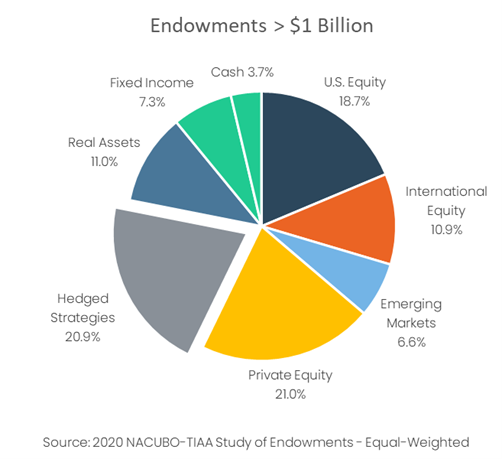

These observations are not new or unique to us. If you look at the allocations of the larger endowments in the illustration below, you can see that these sophisticated pools have made these observations and responded by diversifying broadly by asset class and within asset classes. We have done the same – building diversified portfolios to generate strong returns, but also adding defensiveness through strategies with low correlations and hedged exposures. We have been very pleased over the last two years or so to find and allocate to a number of interesting funds/vehicles that we believe can generate attractive returns come what may in the stock and bond markets. Most of these ideas are expressed through our multi-strategy strategy. Here, we dig into some of these investments and share some of our thinking in real time.

To do so, we thought it might be more efficient to hear from one of the people leading this effort at Gerber Taylor. Rich Johns is a senior member of our public markets research team. He joined us three years ago and has been a terrific addition to our team. Rich has an impressive background for this kind of work. He received a BS in engineering from the U.S. Naval Academy, where he graduated with distinction; an MS in nuclear engineering from Pennsylvania State University; and an MBA with honors from the Wharton School at the University of Pennsylvania. He began his career as an officer on board U.S. Navy Nuclear Submarines. This was followed by a position at McKinsey & Company and stints at two different family offices as CIO. He brought a career of knowledge and unique relationships to Gerber Taylor.

Rich, why is this idea of low correlation so compelling? It seems like the opposite of indexing and indexing has been the reigning champ since the GFC.

No doubt, conventional assets are richly priced. The easiest example to understand this level of richness is the bond market. With the 10-year Treasury Note yielding just over 1.5% on an annual basis, you are guaranteed to lose money, on a real basis, every single year for a decade. Equities are more difficult to predict, but they are in their most expensive decile. When you start at those valuation levels, the outcome is usually not pleasing for the investor. We are excited about the uncorrelated strategies because they are not dependent on conventional stocks or bonds doing well to have a great outcome. These strategies form a core allocation in our multi-strategy approach, which we view as a defensive allocation that is more attractive than bonds, particularly in this environment.

September of this year highlighted the uncorrelated nature of the strategy. In a standard 60/40 equity/bond portfolio, the bond component normally provides protection during periods of equity declines. September, however, showed how this pattern can get turned on its head. Rising interest rates over the course of the month led to negative returns for high quality bond portfolios and impacted stock returns. Most major equity indices were down -4-5% for the month. Conventional asset classes provided no protection to investors. Our strategy, on the other hand, was up for the month.

Can you describe a recent investment that fits the uncorrelated "bill"?

A recent investment we made takes advantage of predictable perturbations in the market during discrete supply/demand mismatches. An example would be a government bond auction. The temporary additional supply causes ripples in the price of the bonds as buyers adjust their portfolios to the new issuance. Think of the ripples formed in a pond after throwing a rock into the water. This fund manager "surfs" these ripples going long and short with little to no directional exposure across the portfolio. These positions are typically held for just a few days. These auctions occur across the world and throughout the year creating a significant number of opportunities to generate returns.

The returns here are completely specific to the trades around specific market dislocations rather than broad market moves. The frequency of dislocations has increased as passive flows, central bank intervention, increased regulation, and greater reliance on high frequency trading have all contributed to market fragility. This creates opportunity for an intense data driven approach to these markets.

Could you describe another example?

A recent investment we made is an electric power trading strategy. Different areas of the United States have electrical grids that operate with their own rules and idiosyncrasies. This fund manager collects massive amounts of data regarding electrical grid function and analyzes the impact weather and other variables like maintenance shutdowns have on the price of power. Power is different from most commodities in that you can't store it at the end of the day. There are no industrial scale equivalents of oil storage tanks or grain silos to store power. What is generated will be consumed, which causes potentially significant price movements even within the same day. This fund's models continuously update the expected price of power from intra-day to weeks in the future. These expected price levels are then compared to the actual prices and where there is significant deviation, a long or short trade is put in place. The other participants in the market are typically generators and users of electricity with much less sophisticated hedging strategies. This causes the market to be relatively inefficient and allows funds like this to generate attractive returns.

The prices of equities and bonds have no impact on the weather or the inefficiencies of the electrical grid, so there is zero correlation between this fund's returns and more traditional asset classes. Many of these electrical grids are also going through a transition from traditional baseline generating assets like nuclear, coal and natural gas to a grid with significant alternative generation assets (solar and wind). This grid evolution introduces even more uncertainty and weather dependence to electricity prices which could make this strategy even more attractive in the future.

How do you think about risk management and sizing for these types of idiosyncratic strategies?

Sizing is an important consideration and a volatile strategy like power trading will never be one our largest positions. However, when you pair a strategy like this with a couple of other uncorrelated commodity trading strategies, the resulting basket can be meaningful (~10-15%). In this case, the other two managers are a Houston based fund that trades U.S. natural gas and a London based fund that trades European natural gas. One great characteristic these managers share is that not only are they uncorrelated to traditional equity and fixed income indices, but they are also uncorrelated to each other. Despite the fact that each of these strategies is highly volatile, once you put them together in this basket, the volatility drops significantly. As Nobel laureate Harry Markowitz said, diversification is the only free lunch in investing and diversifying amongst uncorrelated managers is akin to getting a free dessert with your free lunch.

How persistent are these opportunities?

It really depends on the strategy. Some of these uncorrelated strategies have a half-life or a limited time when they can produce excellent risk-adjusted returns before those returns get competed away. Litigation finance is a classic example of an uncorrelated strategy whose returns have been diminished materially in the last five years after capital flooded into the space. It’s important to have a consistent and continuous research effort to replenish the investment pipeline.

These strategies seem like the holy grail of investing — low correlation with traditional asset classes, attractive returns, and downside protection. How are you able to source and gain access to strategies in high demand, particularly in the current market environment?

One of the great things about working at Gerber Taylor is the longevity of the organization. When our first discretionary commingled investment strategy started in 1991, the alternative industry was in its infancy. We still have manager relationships that stretch back to the beginning with some of the most talented, well known, and high performing funds in the world. These networks are a great help in identifying and accessing some amazing groups that just don't show up on the radar of most investors.

In addition, Alex Moore and I have forty years of investment experience between the two of us, not to mention the rest of the GT team. We have all cultivated complementary sourcing networks over the decades and have close friends in all corners of the industry. These relationships allow us to find and conduct effective due diligence on a wide range of funds and investment opportunities. In fact, the first opportunity I mentioned earlier was sourced from a good friend of mine who is the chief investment officer at a very sophisticated family office. Due to this relationship, Gerber Taylor was one of only a few investors to even see this fund. The amount of capital this fund can effectively manage is limited and there are only five investors in the fund. We are very excited to be one of them.

Thinking about 2008, in the panic, all assets seemed to behave as one. Someone yells fire, and everyone heads to the exits at the same time. What makes these strategies behave differently, and do you expect these low correlations to hold in the next selloff?

The weather doesn't care what the stock market does on any given day, month, or quarter. Weather is the most important driver of power prices in the short and medium term and is completely independent of more traditional asset class price movements.

Returning to the other group I mentioned that "surfs" market dislocations, a trade focused on the temporary price dislocations caused by supply/demand mismatches in Treasury auctions, for example, has the wonderful property that they typically do even better when markets get ugly. The more market participants get rattled, the greater the price discrepancies that arise that the manager can take advantage of. This fund was up almost 10% in March of 2020 when equity and fixed income markets around the world were severely impacted by the pandemic.

That is a wonderful quality – several years ago we wrote about the concept of “Antifragile”, a term coined by Nassim Taleb. That seems like the opposite of many portfolios today, which are over-optimized or overly fitted to recent conditions — and inherently more fragile.

I was thinking recently about why many portfolios are currently over-optimized. The same financial conditions have been in place for a decade or more – the outperformance of U.S. equities and high-quality bonds (or at least until the beginning of this year). The portfolios really over-optimize themselves. The longer the ecosystem remains favorable to one portfolio style, the more portfolios will converge to that same allocation as they are compared to and compete with one another. Other competing portfolios (and firms for that matter) are gradually swept aside as they can’t compete with the over-optimized portfolio. Financial Darwinism is at work as individuals and committees migrate to what has worked recently (and not so recently given the duration of this particular episode).

Similar to machine learning on a limited data set, the longer the same conditions persist, the more competition is swept aside and the more “optimized” and less robust these portfolios get (for example, favoring tech managers and long duration bond managers). Of course, when conditions finally do change (maybe they have changed?), the over-optimized portfolios will underperform and perhaps severely. We expect that the shift away from the original allocation to a competing, more robust allocation will be slow given institutional inertia and recent memory of the good performance.

Rich, thank you for sharing your insights. That’s a great summary of the value proposition for uncorrelated strategies and a perfect place to end our discussion. Investors face a difficult path forward with elevated valuations on both the equity and bond fronts, further complicated by the Fed’s plans to withdraw support for the markets through reduced bond purchases and the uncertainty around inflation. We believe uncorrelated strategies are one tool investors can utilize to navigate such an environment.