Research-Driven.

A complex and ever-changing investment landscape provides challenge and purpose for our team.

Biotech’s Slump: Symptoms, Diagnosis, and the Case for Optimism

April, 2025 | Rich Johns and Tanner Baker

- The broad-based selloff has materially impacted biotech markets in Q1 2025. We believe that macro headwinds for the sector are not as severe or long-lived as the panicked market implies.

- There is structural upside in the biotech sector, driven by the significant need for pharmaceutical companies to replenish pipelines as key patents expire over the coming years.

- There are good biotech companies with good science and good management teams that have been sold off indiscriminately.

- Despite recent pressure, there are small- and mid-cap names, where innovation, experienced teams, and deeply discounted valuations create asymmetric upsides. Notably, according to industry reports, 70% of new drug launches originate from emerging biotech companies.

“We believe the market is underappreciating the value of biotech’s innovation, creating an attractive risk/reward balance for the stocks.”

– Biotech Manager

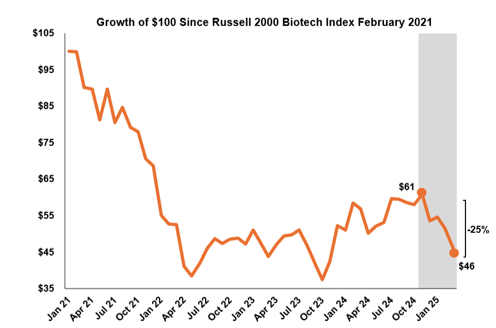

The Russell 2000 Biotech Index remains roughly 50% below its 2021 peak, highlighting a clear disconnect between market performance and the sector's meaningful advances in scientific innovation and drug approvals.

However, as shown in the grey highlight above, starting in December, the biotech index experienced renewed declines. The Russell 2000 Biotech Index was down -13.6% in the first quarter.

We believe recent volatility reflects indiscriminate selling across biotech rather than fundamental weakness, and the absence of natural buyers has exaggerated the downturn. While this overhang has driven sharp dislocations, we remain confident in our long-term thesis and patient in our positioning, though we believe it is important to acknowledge some of the nuanced factors that may be behind the recent drawdown.

FDA personnel turnover creates uncertainty around drug approvals.

- While recent FDA leadership changes seem connected primarily to politically charged areas like vaccine oversight, there is currently no indication of disruption or interference within key therapeutic areas such as oncology, neurology, or inflammation. This concern should dissipate if the FDA demonstrates a rational approval process.

Proposed budget cuts could impact R&D funding and Medicaid.

- Medicaid, a significant portion of U.S. healthcare spending, may face future budget cuts. However, any financial impact on biopharma companies would likely be modest, as Medicaid is already a low-margin market due to substantial mandatory discounts.

Tariffs potentially increase costs and/or disrupt supply chains.

- Trade tensions are unlikely to meaningfully disrupt the sector. Manufacturing costs for small-molecule drugs are a negligible part of pricing, even when production is offshore. Complex therapies such as gene and cell treatments are typically produced domestically due to strict regulations on transporting live biologics. Also, offshore intellectual property structures may help shield pharmaceutical companies from retaliatory trade measures.

Persistent uncertainty and mounting recession fears are driving broad-based selling.

- With institutions constrained by the denominator effect and generalists pausing, natural buyers remain on the sidelines. This pain has been more acute in small- and mid- cap names. As of March 31, companies in the Russell 2000 Biotech Index with market caps under $1 billion averaged declines of -22.3% year to date.

- As a non-cyclical sector, biotech benefits from steady demand for essential care. Regardless of the broader economic backdrop, vital treatments such as oncology and cardiology have organic and sustained demand.

Policy uncertainty has paralyzed M&A activity.

- Pharmaceutical companies face patent expirations regardless of the economic backdrop. The need for pharmaceutical companies to replenish their pipelines has never been higher, coinciding with biotech targets whose valuations have never been lower.

- Tight capital markets and regulatory ambiguity are pressuring high cash-burn companies. As a result, biotech CEOs may be more open to acquisition offers. This dynamic sets the stage for a compelling M&A environment once policy concerns dissipate. Active management remains critical for navigating beyond value traps to identify strong science and capable teams and avoid companies facing distressed takeouts.

- Historically, periods of depressed valuations have initially triggered a small number of acquisitions, leading to a subsequent wave of deals, often catalyzing a rebound in valuations.

“Many biotech valuations sit at record lows even as innovation within the sector accelerates.”

– Biotech Manager

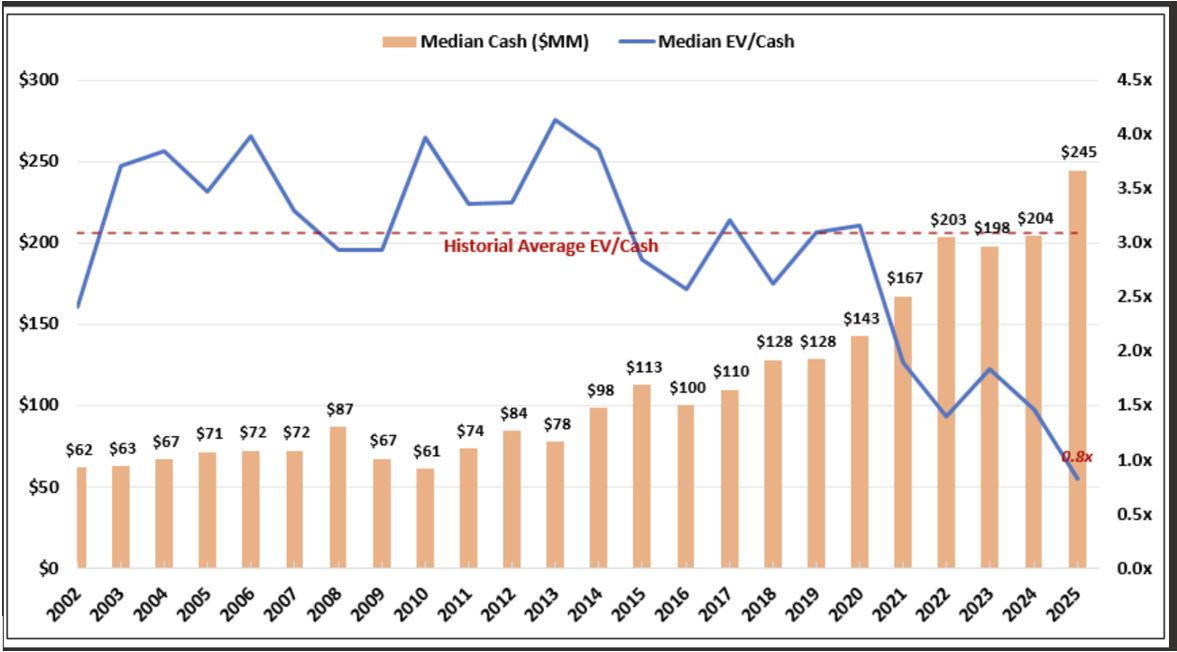

This combination of both macro factors and policy uncertainty has driven biotech valuations to their lowest levels in more than two decades. The median EV/cash multiple for small- and mid-cap biotech stocks is just 1.5x, roughly half the historical average of 3x. At the same time, companies across the sector maintain solid balance sheets with the median biotech cash balance in line with recent years and near historical highs.

Although small- and mid-capitalization biotech remains one of the most unloved areas of the market, this group of companies accounts for more than 70% of new drug launches. We believe our long-term thesis is supported by powerful structural tailwinds that underscore the sector’s potential.

- Aging Drives Demand: The global 65+ population is set to more than double by 2055, fueling demand for biotech solutions to age-related diseases.

- Tech Transforms R&D: AI breakthroughs like AlphaFold2 are slashing drug development timelines—boosting target discovery, refining trials, and cutting costs across the pipeline.

- Faster Approvals: FDA approval times have dropped below one year, just as biotherapeutic pipelines expand 20% annually.

- M&A Tailwinds: Big Pharma faces $350B in patent expirations by 2030. With $1T in cash, acquiring biotech is often cheaper than launching in-house. A looser regulatory climate and mature private companies add fuel to the deal wave.

- Alpha from Dispersion: Wide performance gaps and sector inefficiencies make biotech a rich field for both long and short stock picking.

We do not believe these dislocated conditions will last. But while they do, based on discussions with our managers, we believe they are seeing high-quality assets at decade-low valuations. Biotech is scientifically thriving with robust pipelines and record drug approvals. We believe science will prevail, renewing investor conviction and capital flows, reigniting growth across the sector. Still, we expect this to require patience and a long-term investment mindset.

April 2025

Rich Johns and Tanner Baker