Research-Driven.

A complex and ever-changing investment landscape provides challenge and purpose for our team.

Looking Beyond the Bumps: Opportunities in Biotech

March, 2024 | Andrew Fox

Looking Beyond the Bumps: Opportunities in Biotech

“Fasten your seat belts, it’s going to be a bumpy night." –Bette Davis

This quote from the 1950 Hollywood classic All About Eve is one of the most misinterpreted phrases of all time, with viewers thinking Davis said, “It’s going to be a bumpy ride.” From afar, one could misinterpret 2023’s 10.6% gain for the Russell 2000 Biotech Index as a smooth return during a productive year for equity markets overall. However, 2023 took biotech investors on another bumpy ride that included a bear market with the Russell 2000 Biotech Index troughing at 2,528 and a bull market with the same index peaking at 3,765, for a range of nearly 50%. This volatility is not unusual to biotech investors, as the sector has had nine drawdowns exceeding -30% since 2000. It is worth remembering too that not all price volatility is painful. Often times, it presents savvy managers with an opportunity that they can take advantage of.

When digging deeper into the year’s dynamics, 2023 started with many healthcare commentators bright-eyed about the possibilities of what a new year might bring and the hopeful thawing of a biotech winter. This optimism continued to grow as the calendar turned to March. Then, the abrupt collapse of Silicon Valley Bank (“SVB”) sent shockwaves through the biotech ecosystem. Roughly 50% of U.S. biotech companies banked with SVB in one way or another1. Additionally, SVB itself claimed to have had a relationship with more than 75% of the companies that went public since 20212. SVB’s failure further bifurcated the biotech market in terms of individual company valuation levels. As a result, companies were separated into “haves” and “have-nots” as cash runways shrank, and financing conditions tightened considerably. In fact, one manager we know estimated that there were 191 biotech companies trading below their last reported cash levels at the end of the first quarter of 2023.

Following SVB’s failure, the biotech market bounced back until July when above-target inflation drove hawkish Federal Reserve projections that implied that interest rates would stay higher for longer than previously anticipated. Unsurprisingly, in a rising rate environment, prices of development-stage biotech companies struggled, as biotech company valuations are dependent on cash flows many years in the future. This slide continued until the end of October, with the Russell 2000 Biotech Index falling -24.5% in just four months and entering bear market territory. This negative macro-overhang seemed to overwhelm the fundamentals within the biotech sector.

Thankfully for biotech investors, this abruptly reversed course in November when the Federal Reserve signaled that the tightening cycle was over and that they would pivot to rate cuts in 2024. This change of tune fueled renewed investor optimism and led to the Russell 2000 Biotech Index rising 39.1% from the start of November through year end. Spurred on by a change in sentiment surrounding rates, merger and acquisition activity renewed and reached ~$36 billion, nearly 30% of total deal value for the year in just November and December alone. Our thesis continues to be that M&A activity will serve as a catalyst for the market to recognize the underlying value embedded in many individual biotech stocks. This is especially true as large pharmaceutical companies grow mostly through mergers and acquisitions.

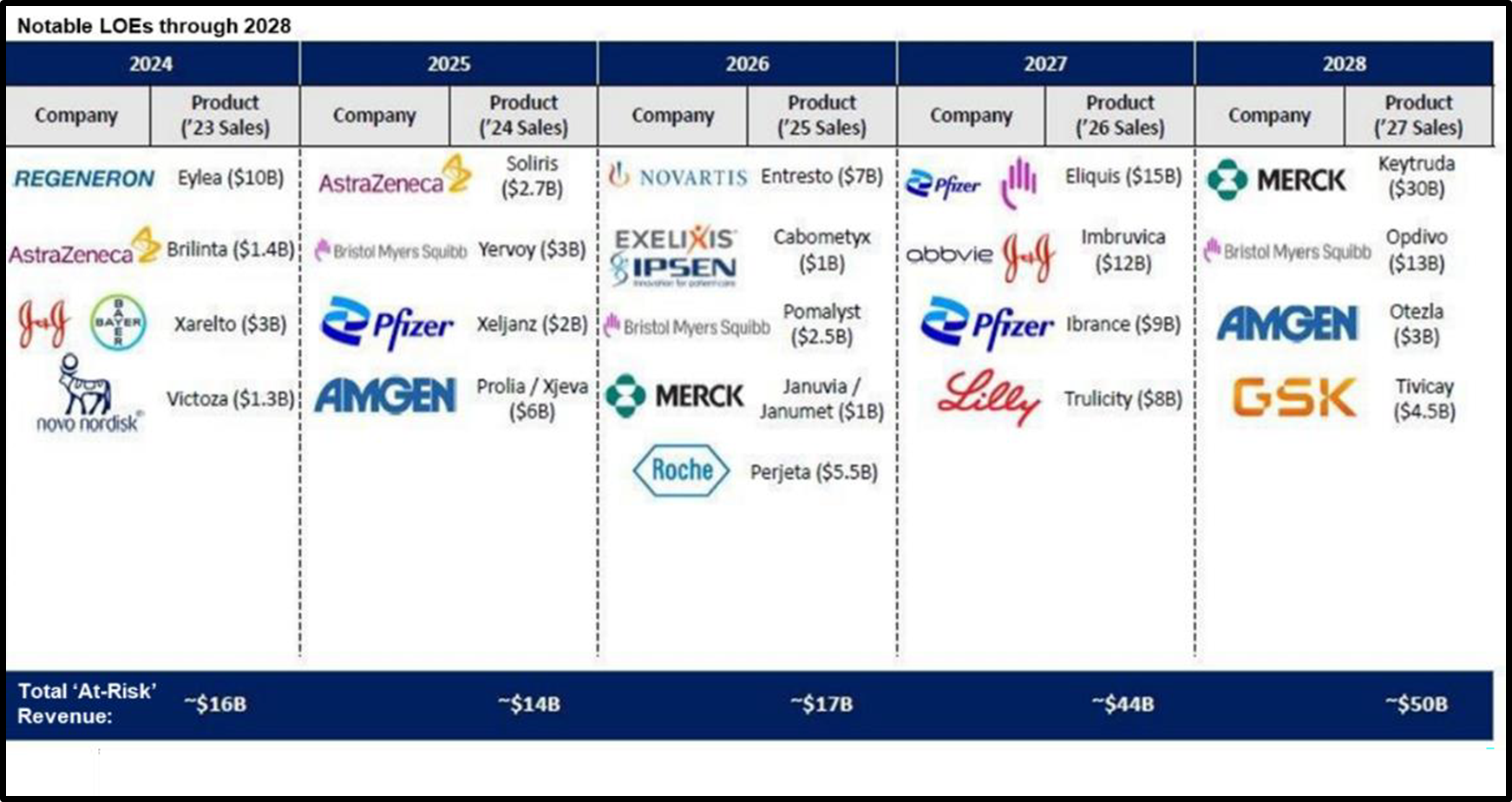

Fueled by a post-COVID overhang, these companies have a $700 billion war chest to spend on acquisitions. We believe they are primed to take advantage of depressed valuations in the sector, especially as drug patents covering nearly $140 billion of revenue are expected to lose their exclusivity over the next five years, as shown in the chart below.

Our long-term approach to biotech remains unchanged. We entrust capital to biotech managers who have developed a rare combination of medical expertise and investment acumen. We believe such managers have a distinct edge and can offer significant risk mitigation in a particularly volatile space. Many managers have used the market selloff to opportunistically upgrade their long portfolios, targeting high-quality companies that were selling for historically cheap valuations. The current market environment is conducive for biotech sector specialists, as firms are paying premiums to acquire companies with good scientific data, as evidenced by the resurgence of merger and acquisition activity in November and December. On the short side, many companies which IPO’d in 2021 have dwindling cash balances and no applicable scientific use cases, making them ideal short targets. Over the long run, we believe the setup is favorable for active management to generate alpha through individual stock selection on both the long and short sides as opposed to broad momentum investing.

We remain optimistic about the future for the biotech sector as a whole, and more so for managers that possess a combination of investment edge and risk management. The fundamental drivers of our optimism—aging populations, ongoing healthcare advancements, and breakthroughs in treating rare diseases—remain as strong as ever. With the Russell 2000 Biotech Index still down -51.5% from its February 2021 peak through March 31, 2024, we believe this offers an attractive entry point. However, as we expect ongoing volatility, biotech is not for investors faint of heart or those focused on short time horizons. Therefore, acknowledging that there will inevitably be bumpy nights along the way, we believe biotech deserves consideration for those investors willing to fasten their seatbelts and settle in for a longer ride.

March 2024

Andrew Fox

1Wingrove, Patrick. "SVB fall casts shadow on early-stage U.S. biotech." Reuters. Published March 13, 2023. Accessed from https://www. reuters.com/business/finance/svb-fall-casts-shadow-early-stage-us-biotech-2023-03-13/.

2Fidler, Ben. "SVB’s failure was contained. Its effects on biotech could still linger." BiopharmaDive. Published March 14, 2023. Accessed from https://www.biopharmadive.com/news/svb-collapse-biotech-startups-bank-failure/644896/.