Research-Driven.

A complex and ever-changing investment landscape provides challenge and purpose for our team.

A Focus on “Actively Creating Value”

May, 2025 | Tara Elliott

Reflecting on 2024, our research team homed in on five key themes: elevated policy uncertainty; equity market concentration; the impact of passive investing on time horizons and volatility; the broad opportunity set outside of large cap U.S. equities; and the importance of manager selection. Those issues moved to the forefront in 2025.

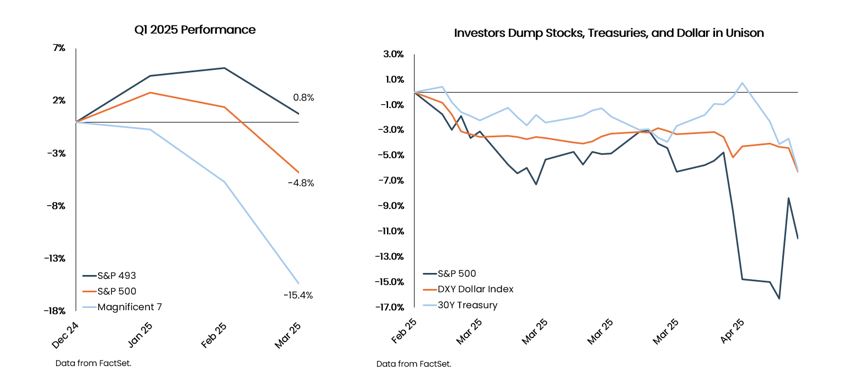

The exuberance over the U.S. hyperscalers, to the exclusion of nearly everything else, may have peaked at the end of the year when the market capitalization of the top 10 stocks accounted for 37% of the S&P 500 and were largely responsible for its returns in 2023 and 2024. The new presidential administration’s pursuit of rapid policy changes resulted in investor caution and a risk-off sentiment, led by the previous market darlings.

Policy uncertainty reached extreme levels in April with the announcement of the surprisingly high “reciprocal tariffs” on April 2, “Liberation Day.” The shock drove U.S. equity prices down sharply with the S&P 500 entering correction territory (down >10% from previous high) and the tech-heavy Nasdaq falling into a bear market (down >20%) by April 8.

Unfortunately, for many investors, U.S. Treasury bonds and the U.S. dollar, traditional safe-havens, offered no respite as investors sold U.S. assets across the board. The 10-year U.S. Treasury yield, which had dipped to 3.9% (low) on April 4, surged to 4.5% by April 9, marking its largest three-day increase since 1982. The selling pressure on Treasuries (prices move inversely to yields) was attributed to renewed inflation fears as a result of higher tariffs, foreign selling, and the unwinding of levered trades utilizing Treasury bonds as a component. This prompted prominent economists, including former United States Secretary of the Treasury Larry Summers, to compare the treatment of U.S. dollar-denominated assets to those of a troubled emerging market.

In fact, it was reportedly the spike in yields, which increases government borrowing costs, that convinced President Trump to pause most new tariffs, excluding those on China, for 90 days on April 9. Markets rallied strongly on that news but have since traded range-bound awaiting further clarity.

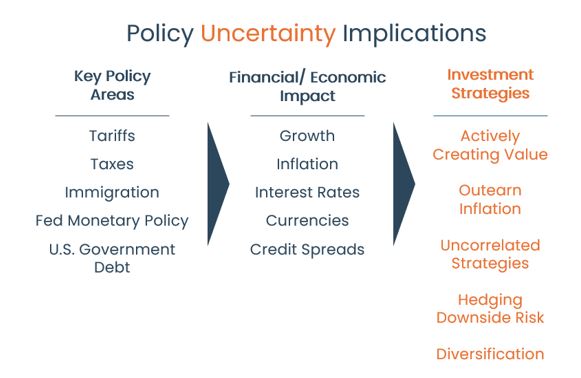

Tariffs are just one of many policy areas with implications for financial and economic conditions. Markets, and investors, detest uncertainty as evidenced by the volatility in both the stock and bond markets. Realized volatility on the S&P 500 hit 51 in April, a level only seen in four periods since the start of World War II: the 1987 Black Monday market crash; the 2008 financial crisis (“GFC”); the 2011 US debt downgrade; and the 2020 COVID pandemic. Meanwhile, the range of the yield on the 10-year Treasury during the week of the Liberation Day tariffs was wider than for any other week during the previous 35 years, outside of the GFC and the global pandemic.

Understandably, investors are questioning how to position portfolios in such an environment. We have been using the graphic below to illustrate our “prescription.”

Readers who are familiar with our approach are likely to observe that these are not new themes for GT. It is true that we favor an all-weather approach and have always stressed that we don’t rely on macroeconomic forecasts. In fact, we believe our approach is much more suited to today’s environment than much of the period since the GFC. Other than during 2022, another distinct period when stocks and bonds were both down significantly at the same time, cheap market beta with little regard for diversification or downside protection has been a particularly rewarding strategy.

We draw a sharp contrast from that approach to our penchant for investments that include a component of “manufactured alpha.” By this, we mean strategies where the managers “actively create value,” rather than just buy straight up market risk or select a good investment and hope for market tailwinds. This is an important consideration in how we construct our hedged strategies, which we prefer to a large fixed income allocation for portfolio defense, even in light of higher prevailing yields. About a year ago, we highlighted the role of hedged strategies using the following graphic in an investor letter. Little did we know what conditions we were conjuring!

Another important source of value creation is private equity, at least the way we approach it. The following excerpt from Kojo McLennon’s letter on private equity fleshes out this point: “The majority of the industry activity involves the largest funds and the largest private companies. Bidding for deals tends to be very competitive, and purchase prices have mirrored recent public equity markets with higher valuations. Successful outcomes in the large buyout space often rely on financial engineering and significant debt financing, which is more expensive and harder to come by in today’s environment. We have always favored less competitive areas of the private markets where managers can drive returns independent from the public markets. As such, we do not plan any material changes to our strategy.”

Bill Ryan’s recent letter on the real assets describes our efforts to build an allocation that offers inflation protection, in addition to income generation and capital appreciation. He further highlights that our approach, in true Gerber Taylor fashion, avoids following the crowd and seeks out more niche strategies that suffer from a dearth of capital and/or benefit from a manager’s active involvement. “The managers we seek out are doing the scrappy work of building platforms with stable earnings that larger capital pools seek.”

May 2025

Tara Elliott